Mastering Forex Paper Trading: A Comprehensive Guide

Forex paper trading is an excellent way for traders to hone their skills without the risk of losing real money. This simulated trading environment allows users to practice strategies, test their understanding, and gain confidence in their trading abilities. For those looking to dive into the Forex market, finding the forex paper trading Best UAE Brokers can be an important step in ensuring you have the support and resources needed for your trading journey.

What is Forex Paper Trading?

Forex paper trading refers to the practice of simulating trades in the foreign exchange market without using real money. Instead of placing actual trades, traders use a demo account to track their trades on paper, objectively observing how they would perform in real market conditions. This method significantly benefits beginners who want to learn how to navigate the Forex market without incurring financial risk.

Benefits of Forex Paper Trading

There are numerous advantages to engaging in Forex paper trading:

- No Financial Risk: The primary benefit is the safety of not risking real money. Trainees can experiment with various strategies and tools without fear of incurring losses.

- Understanding the Market: It helps beginners understand market dynamics, how to read charts, and the impact of economic events on currency movements.

- Developing a Trading Strategy: Traders can test and refine their strategies to see what works best for them based on market behavior.

- Gaining Confidence: As traders see their simulated trades perform well, they build confidence, which is crucial when they transition to live trading.

- Learning to Manage Emotions: Paper trading can help traders learn to manage their emotions—an essential skill for trading success—without the pressures of real monetary stakes.

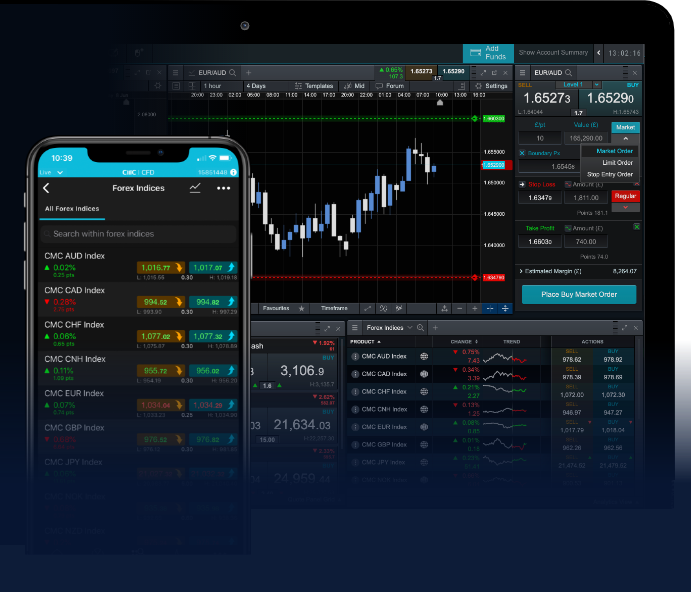

Setting Up Your Paper Trading Account

Most trading platforms offer demo accounts that enable paper trading. Here are the steps to set one up:

- Choose a Broker: Select a reputable Forex broker that offers a demo account. Ensure they provide a user-friendly platform and good resources for beginners.

- Register for a Demo Account: Fill out the necessary registration form, then download the trading platform if required. Most platforms are accessible via the web or mobile apps.

- Deposit Virtual Funds: Once your demo account is set up, you’ll typically receive a set amount of virtual currency to trade with. This amount can simulate a realistic trading environment.

- Start Trading: Begin executing trades as you would in a real account. Familiarize yourself with the tools provided by the platform and practice your strategies.

Strategies for Successful Paper Trading

To effectively leverage paper trading, consider the following strategies:

- Define Clear Goals: Set specific objectives for your paper trading sessions. This could include mastering a particular trading strategy or developing risk management skills.

- Track Your Trades: Keep a detailed log of your trades to analyze what worked and what didn’t. This reflection will help you identify successful strategies and areas for improvement.

- Vary Your Strategies: Experiment with different trading strategies—such as scalping, day trading, and swing trading—until you discover what best suits your trading style.

- Simulate Real Conditions: Treat paper trading as seriously as you would live trading. Avoid falling into the trap of careless trading since it’s “just” a demo. This will help you develop the discipline needed for when you start trading real money.

- Review and Adjust: Regularly review your trading results and be willing to adjust your strategies and tactics based on performance and changing market conditions.

Common Mistakes to Avoid in Paper Trading

While paper trading is a valuable tool for growth, many traders make common mistakes that can hinder their development. Here are a few to avoid:

- Ignoring Risk Management: Many paper traders neglect to apply proper risk management techniques, which can lead to unrealistic expectations when they transition to real trading.

- Making Emotional Trades: Without real money on the line, it’s easy to trade impulsively. Develop strong decision-making skills instead of succumbing to emotional responses.

- Failing to Log Trades: Not keeping a record of trades can cause missed opportunities for learning. Always track your trades to understand patterns in your decision-making.

- Trading Inconsistently: Switching between different strategies too frequently can lead to confusion. Stick to a few strategies long enough to evaluate their effectiveness.

Transitioning from Paper Trading to Real Trading

When you’re ready to move from paper trading to real trading, consider these steps:

- Start Small: Begin with a small amount of capital that you can afford to lose. This will alleviate some pressure as you adjust to live trading.

- Apply What You’ve Learned: Use the strategies and insights you’ve gained during paper trading in your live account. Continuity between modes is key to building confidence.

- Set Realistic Expectations: Understand that your results may differ in real trading due to emotional factors. Stay patient and give yourself time to adapt.

- Continuous Learning: Stay committed to ongoing education and improvement, whether it’s a new trading strategy, technical analysis, or understanding economic indicators.

- Seek Support: Utilize the resources available to you, such as trading communities, mentors, and brokers who can provide guidance as you make the transition.

Conclusion

Forex paper trading serves as a fundamental practice tool for aspiring traders. It allows individuals to develop essential skills and strategies in a safe environment. By approaching paper trading with the right mindset, setting achievable goals, and learning from mistakes, traders can build a solid foundation for successful trading in the real market. As you explore the exciting world of Forex trading, remember that the right broker can make a significant difference in your success. Always do your research to find the Best UAE Brokers that fit your trading needs.

Leave a Reply